Predicting a housing market crash in 2025 is speculative, as it depends on numerous evolving economic factors. Current trends and historical data provide insights, but not certainties.

The housing market’s stability is a topic of much speculation and debate among economists, investors, and prospective homebuyers. Understanding whether a market crash is on the horizon requires considering various indicators such as interest rates, employment figures, housing supply and demand, and broader economic trends.

Historical patterns can offer some guidance, but each real estate cycle is unique. The years leading up to 2025 are likely to see shifts in policy, technology, and consumer behavior, all of which could impact the housing market positively or negatively. As 2025 approaches, keeping a keen eye on these indicators will be crucial for anyone involved in the housing sector. It’s essential to approach predictions with caution, remembering that real estate is inherently linked to a complex array of national and global economic forces.

Credit: www.linkedin.com

The Pulse Of The Housing Market

Analyzing the pulse of the housing market is crucial for investors, homebuyers, and economists alike. The question on everyone’s mind is: “Will the housing market crash in 2025?” This analysis delves into the vital signs of the housing market, revealing patterns and indicators that help predict the future.

Key Indicators To Watch

Key data points provide insight into the health of the housing market:

- Interest rates: They affect buying power and demand.

- Inventory levels: High inventory can signal a buyer’s market.

- Home prices: Rising prices may indicate a robust market, while falling prices could signal trouble.

- Construction activity: New builds reflect developer confidence and market growth.

- Economic indicators: Employment rates and GDP growth influence housing demand.

- Foreclosure rates: Higher rates can lead to a market downturn.

Historical Market Trends

History often sheds light on future possibilities. Let’s look at the past to understand what might lie ahead:

| Year | Market Trend | Event |

|---|---|---|

| 2008 | Crash | Subprime Mortgage Crisis |

| 2012 | Recovery | Market Bottom |

| 2020 | Boom | Pandemic Effect |

By examining these trends, we can look for patterns that may repeat. Nonetheless, markets are dynamic, and past performance is not always a reliable indicator of future results.

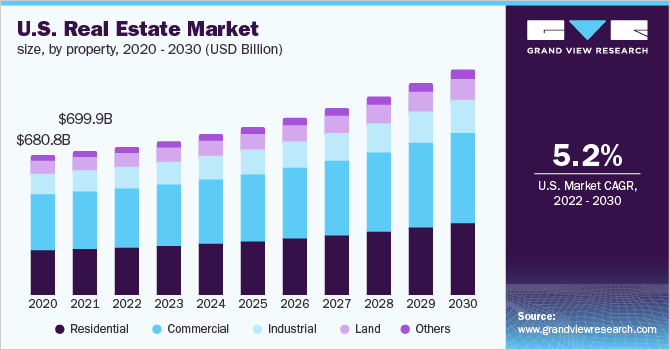

Credit: www.grandviewresearch.com

Economic Forecast For 2025

Many eyes are on the economic horizon of 2025. Experts weigh in on trends that may influence our finances. One burning question stands out: Will the housing market crash? A glimpse into global economy predictions and interest rate trends reveals insights.

Global Economic Predictions

Global economic health is a key factor. Analysts study several indicators to predict where we are heading. They consider gross domestic product (GDP), trade relations, and political stability. Here are some anticipated global trends for 2025:

- Emerging markets could see accelerated growth.

- Developed countries might experience moderate expansion.

- Technology advances will continue to drive economic change.

Interest Rates And Housing Demand

Interest rates have a direct impact on housing affordability. They influence a buyer’s decision to enter the market. Let’s explore some interest rate predictions for 2025:

| Year | Interest Rate Forecast | Expected Impact on Housing Demand |

|---|---|---|

| 2025 | Potentially stable, slight increase | Maintain current demand levels |

Central banks may adjust rates to manage economic growth. Both buyers and sellers will keep a close watch on these changes. They guide housing market decisions.

Real Estate Supply Dynamics

The future of the housing market often lies in understanding supply dynamics. We explore how construction trends and inventory levels might signal the potential for a market crash in 2025. Insights into these factors provide clues on whether we’ll see an oversupply, balanced market, or a shortage of homes.

Construction Trends

Construction activity influences future home availability. Recent data suggests a shift, with several points to note:

- Material cost fluctuations impacting new builds

- Changes in zoning laws possibly speeding up construction

- Green building practices altering traditional construction

Each of these developments affects how many new homes will enter the market. A spike in new construction could lead to an oversupply, stressing prices downward.

Inventory Levels

Current inventory levels offer a glimpse into future market stability. Look out for:

- Monthly inventory statistics released by real estate associations

- Year-over-year comparisons to judge market trends

- Regional analysis for a more localized picture

Low inventory suggests higher demand, possibly averting a crash. Alternatively, a consistent rise in inventory may indicate a looming oversupply.

Close monitoring of these dynamics is crucial to predicting the housing market’s direction in 2025.

Demand Factors Influencing The Market

Demand factors play a crucial role in determining the dynamism of the housing market. Understanding these factors is key to predicting whether a market crash might be on the horizon in 2025. Let’s delve into the specific aspects of demand that could shape the future of real estate.

Demographic Shifts

Demographic trends significantly affect the housing market. Changes in population size, age distribution, and household composition can lead to shifts in housing demand:

- Millennials reaching home-buying age: This group may drive demand for starter homes.

- Baby boomers downsizing: A surge in smaller, more manageable homes might be needed.

- Urban to suburban migration: Preferences for larger homes with office space could rise.

Buyer Sentiment

Buyer confidence influences housing demand:

| Market Condition | Impact on Buyer Sentiment |

|---|---|

| Economic stability | Boosts confidence, possibly increasing demand. |

| Interest rates | High rates may deter buyers, low rates can encourage purchases. |

| Employment rates | More jobs can lead to higher housing demand as people feel financially secure. |

Social influences and media coverage also play roles in shaping buyer opinion. Positive news can spike interest in housing investments, while negative reports can lead to caution and reduced demand.

Government Interventions And Regulation

Questions buzz around the housing market’s fate in 2025. Eyes often turn to the government for cues. Will policies steer the market to safety or cliff’s edge? This crucial role of regulation shapes paths of boom or bust. Let’s uncover how government actions could tilt the scales, examining housing policies and tax incentives.

Housing Policies

Housing policies wield power over the market’s pulse. They decide who can buy and who must wait. They can crush bubbles or inflate them. Here, we decode how fresh policies might be the market’s making or undoing.

- Rental assistance programs: Aim to help renters stay in homes.

- Affordable housing initiatives: Increase housing stock for low-income families.

- Land use reforms: Make more land available for development.

- Building codes updates: Ensure safety and sustainability of new homes.

Tax Incentives

Tax perks can make owning homes more inviting. Or push investors to pour cash into bricks and mortar. Will they serve as anchors or sails in the stormy seas of 2025’s market?

| Incentive Type | Potential Impact |

|---|---|

| Mortgage Interest Deductions | More home buying |

| Property Tax Deductions | More affordable homeownership |

| Capital Gains Tax Relief | More investment in housing |

| Depreciation for Rental Properties | More rental property investments |

Credit: www.gartner.com

Technology And Real Estate

The intersection of technology and real estate, commonly known as Proptech, is revolutionizing the housing market. Pioneering tools and platforms are not only streamlining transactions. They are also impacting predictions around a potential housing market crash in 2025. Buyers, sellers, and real estate professionals tune in to these tech trends for insights into the future market landscape.

Proptech Innovations

Smart home technology and virtual reality tours have become the norm in property marketing. AI-powered property management systems optimize rent collection and maintenance tasks. Blockchain technologies promise more secure and efficient transactions. Here’s a snapshot of proptech advances:

- Smart Home Devices: Thermostats, locks, and lights that owners control remotely.

- Virtual Reality (VR): Enables potential buyers to tour homes from anywhere.

- Artificial Intelligence: AI can predict maintenance needs and suggest timely repairs.

- Blockchain: Streamlines the closing process with faster, safer title transfers.

These innovations contribute to a fluid and dynamic housing market, which could defy a simple crash prediction.

Market Analysis Tools

Investors and analysts use advanced tools to forecast market trends. Big data plays a key role in this analysis. With precise algorithms, experts can sense shifts and make informed decisions. Let’s peek at the tools shaping these analyses:

| Tool Type | Function | Impact |

|---|---|---|

| Machine Learning Models | Analyze past and current data to forecast futures prices. | Anticipate market movements. |

| Heat Maps | Showcase area popularity based on various indicators. | Identify hotspots for investment. |

| Investment Analysis Platforms | Calculate potential ROI on properties. | Guide investment strategy. |

| Sentiment Analysis Tools | Gauge public opinion from online data and social media. | Predict buyer and seller behavior. |

Armed with these sophisticated market analysis tools, professionals can better predict and prepare for potential changes. The question of a market crash thus becomes nuanced, informed by real-time data and trend analysis.

Comparative Analysis

Discussing whether the housing market will crash in 2025 requires a deep dive into patterns and data. By comparing past and present market conditions, experts attempt to predict future trends. This comparative analysis will look closely at earlier housing market crashes and align them with today’s circumstances to provide insights into what might happen in 2025.

Previous Housing Crashes

Historical housing crashes offer invaluable lessons. To understand the potential of a future crash, reviewing past downturns in the housing market is crucial. The following points highlight pivotal crashes.

- 2008 Financial Crisis: Triggered by mortgage defaults, it led to a massive fall in housing prices.

- 1990s Housing Slump: Economic recession and high interest rates caused home values to decline.

- 1980s Savings & Loan Crisis: Overbuilding and risky lending saw a sharp drop in the housing market.

These instances showcase how various economic factors, such as interest rates, lending practices, and economic conditions, influence the housing market.

Current Market Versus Past Cycles

Today’s market conditions are unique, yet echoes from the past remain. Let’s compare so we can speculate on 2025:

| Aspect | Past Crashes | Current Market |

|---|---|---|

| Economic Climate | Often recession-driven | Recovering from a pandemic |

| Interest Rates | High rates were common | Historically low, now rising |

| Lending Standards | Lax before crises | More stringent post-2008 |

| Market Supply | Often excess supply | Current low inventory |

In these respects, the landscape differs notably from previous downturns. While the past does not dictate future events, it can illuminate potential paths. The key takeaway: while patterns do resurface, the current market’s distinct nuances point toward its own trajectory, one that must be watched closely as we approach 2025.

Expert Opinions And Predictions

Expert opinions and predictions are vital for understanding future market trends. Many ponder the stability of the housing market as we approach 2025. Will the market maintain its strength, or are we on the precipice of a crash? Let’s delve into various expert insights to gauge what the future may hold.

Economists’ Views

Economists hold diverse predictions about the housing market in 2025. Their forecasts consider current economic indicators, historical patterns, and emerging trends. Some anticipate a cooling period, while others predict continued growth or potential market correction.

- GDP growth rates – Economists analyze these to predict housing demand.

- Employment trends – Job stability can influence buying power.

- Interest rates – Changes can affect affordability and borrowing.

A consensus on the exact outcome may be elusive, but the analyses help frame potential scenarios. With this knowledge, buyers and sellers can make informed decisions.

Real Estate Professionals’ Insights

| Insight | Impact |

|---|---|

| Inventory levels | An indicator of market health; low inventory may drive up prices. |

| Buyer demographics | Millennials entering the market can influence demand. |

| Technology in real estate | Advancements might streamline transactions. |

Real estate professionals offer a ground-level view. They foresee technology shaping the industry. They note buyer trends and inventory levels to predict the market’s direction. These insights, combined with economic data, offer a richer forecast for 2025.

Frequently Asked Questions For Will The Housing Market Crash In 2025

Will 2025 Be A Good Time To Buy A House?

Predicting the housing market for 2025 is challenging as it depends on economic factors, interest rates, and housing market trends. Always consider your financial situation and market conditions before making a purchase.

Is 2024 A Good Year To Buy A House?

Predicting the housing market for 2024 is challenging due to economic uncertainties. Base your decision on personal financial stability, market trends, and professional advice. Always consider mortgage rates, location demand, and long-term goals before purchasing a home.

Will The Us Housing Market Crash In 2024?

Predicting a US housing market crash in 2024 is speculative. Market dynamics depend on economic factors, which are subject to change. It’s essential to consult current trends and expert analyses for insights.

What Will The Mortgage Rate Be In 2025?

Predicting exact mortgage rates for 2025 is challenging due to fluctuating economic factors. Consult financial experts and use forecasting tools for the latest insights.

What Triggers A Housing Market Crash?

A housing market crash is typically triggered by a combination of high-interest rates, widespread mortgage defaults, and speculative bubble bursts, leading to a sudden drop in property values.

Conclusion

Predicting the future of the housing market is no simple task. Economic indicators and expert analyses offer guidance but no certainty. The possibility of a market decline in 2025 exists, yet only time will reveal the outcome. Vigilance in monitoring trends will serve potential buyers and investors well.

Stay alert, stay informed.